Education, Tools, Support: How REI Automated Arms Real Estate Investors with the Keys to Success

Real estate investment is one of the most powerful wealth-building vehicles available today, but the path to success can feel overwhelming for newcomers and even seasoned investors. Keith Gillispie, the founder of REI Automated and a smrtPhone Affiliate, knows this journey well. Having spent nearly half a million dollars of his own money learning from some of the biggest names in real estate, including Ron Legrand, Robert Kiyosaki, and John Martinez, Keith’s journey from investor to mentor has equipped him with a wealth of knowledge and experience.

Before starting REI Automated, Keith was just like many of the real estate investors he now serves. He was hungry for knowledge, willing to learn from the best, and dedicated to making his mark in the industry. But Keith realized that simply absorbing information from various experts wasn’t enough. What he needed—and what others needed—was a system to streamline success. So, he did exactly that: synthesizing the lessons learned from over 50 mentors into a comprehensive and effective approach to real estate investment.

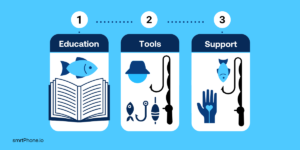

At the heart of REI Automated is a core philosophy built around three foundational pillars: Education, Tools, and Support. These pillars work together to create a system that empowers real estate investors to thrive, no matter where they are in their journey. Keith compares this approach to teaching someone how to fish. First, you need to show them how to catch the fish (education), give them the best rod and reel (tools), and then stick around to guide them when they face challenges along the way (support).

“I am, first and foremost, a real estate investor, and I am my own biggest client,” says Keith. “But now we empower other real estate investors to build and scale a profitable business, and we have a three-tiered approach: education, operating system, and support.”

Let’s dive deeper into how REI Automated helps real estate investors succeed through these three pillars.

1. Education: Mastering the Fundamentals of Real Estate Investment

The first and most critical step in becoming a successful real estate investor is education. While it might not always feel as exciting as making calls or closing deals, building a solid foundation of knowledge is essential. REI Automated offers a wealth of educational resources designed to help investors not only understand how to use their systems but also grasp the core concepts of real estate investment. Their video library tackles concepts from deal structuring and marketing to negotiation and closing.

Keith’s educational content is both comprehensive and deeply practical. He has created nearly 300 videos that cover everything from high-level best practices to the nitty-gritty details of real estate investment.

“I’ll teach you how to do the deal structure, I’ll teach you how to do the marketing, teach you how to do the sales and negotiation. Next step is the deal analysis, and now we have to take that contract to close, so on and so forth,” Keith explains.

The learning process begins with mastering the basics: buying houses, securing equity, negotiating favorable terms, and understanding critical concepts like arbitrage with interest rates and the importance of getting great prices. Once investors understand the foundational concepts, Keith emphasizes the importance of taking action.

Keith’s philosophy doesn’t just teach investors how to close deals. He helps them refine their craft, ensuring they understand how to work with motivated sellers, analyze deals, and successfully negotiate outcomes that benefit both parties.

“I’ll teach you how to negotiate properly—building rapport, mirroring, and understanding how to create value without making the seller feel like you’re beating them over the head with price,” he says.

Keith also addresses a common question that many new investors face: Should I focus on time or money?

“For some people, the constraint is time,” Keith says. “They have a lot of capital, but only a couple of hours a day to devote to real estate. For them, I recommend high-return strategies like SEO, PPC, billboards, and TV ads. For others, like college students with little money, but a lot of time, we focus on strategies like door knocking, cold calling, and hanging bandit signs.”

By tailoring the education and strategies to the investor’s specific core constraint, Keith helps everyone—from full-time professionals to part-time hustlers—find the right way forward.

“You can make an educated decision based on your core constraint, because there’s no right or wrong way. It’s right or left. Every person’s in a different season of their life or investing career,” he explains.

2. Tools: Equipping You for Success

“The second pillar of REI Automated’s approach is giving real estate investors the tools to execute their strategies. Once you know how to structure deals and negotiate, you need the right resources to act on those strategies.

“Pillar two: After educating you, I provide the tools, resources, and software to carry out what I’ve taught you,” says Keith. “Think of it like a classroom. You watch videos for pillar one—education. Pillar two is the operating system with the tools you need to execute.”

From automated systems for lead generation to scripts for cold calling and negotiating, REI Automated ensures investors have what they need at every stage. Whether pulling comps, determining ARV (After Repair Value), or choosing between financing strategies, these tools simplify decision-making.”

“We want to create consistent results, just like a conveyor belt,” Keith explains. “If you have consistent inputs, you’ll get consistent outputs. We’ve perfected this ‘Mickey D’s method’ where everything is systematic and scalable.”

Keith also emphasizes the importance of speed to lead. When a lead comes in, it’s crucial to respond as quickly as possible—before the lead reaches out to competitors. Automated text messages and follow-up sequences are integrated within the system to ensure that no lead slips through the cracks.

“That’s why we focus on speed to lead—getting to them quickly,” Keith explains. “I don’t want to create competition. I want to engage with that lead first, so they don’t fill out someone else’s form.”

The system integrates with smrtPhone, a platform designed to automate and streamline communication. With smrtPhone, investors can follow up with leads swiftly, send automated text messages, and maintain seamless communication without manually dialing each lead. As Keith describes, this integration maximizes the speed and efficiency of the entire process.

For example, if a lead comes in at night, the system can automatically trigger a text message through smrtPhone, ensuring that the investor doesn’t miss an opportunity just because it’s after hours. “You can see automated messages went out and engaged this lead immediately. Within minutes, first message went out, 38 seconds after, and they were texting us back at 10:42 PM,” Keith shares.

With smrtPhone’s integration, REI Automated’s speed to lead averages 3 minutes or less—ensuring that no opportunity is left behind.

3. Support: Overcoming Obstacles Together

The final pillar of REI Automated’s approach is support—a key element that sets it apart from other programs. Real estate investing is challenging, and even the most seasoned investors encounter roadblocks along the way. Whether it’s a tough seller, a difficult negotiation, or an unexpected issue, REI Automated offers comprehensive support to ensure that investors never feel like they are navigating these challenges alone.

“It’s important to have a solid support system, so you’re not facing these challenges on your own,” Keith says. “You’ve got a dedicated team who’s there to help you overcome obstacles.”

Keith likens the support system at REI Automated to a Marine Corps tactical team: everyone has each other’s backs. When obstacles arise—like a seller who’s hesitant to agree to terms, or a complex negotiation that stalls—investors can reach out to the team for advice, guidance, and solutions.

“Ultimately, there’s going to be something that you don’t know the answer to,” Keith reflects. “Whether it’s an objection from a seller you can’t overcome or an unfamiliar question, it’s like clearing a building with your team. Everyone relies on the person in front and behind them to succeed.”

This robust support system ensures that investors are always prepared, no matter what challenges arise. This is especially true when combined with good education and tools.

Putting It All Together

At REI Automated, the three pillars—Education, Tools, and Support—work in tandem to create a comprehensive system for real estate investors to learn, implement, and grow. Whether you’re just starting out or looking to scale your existing real estate business, REI Automated’s system provides you with everything you need to succeed.

Keith’s approach isn’t just about teaching investors to close deals. It’s about helping them become empowered, independent entrepreneurs who can navigate the complexities of the real estate market with confidence and skill.

“Real estate investing is a marathon, not a sprint,” Keith concludes. “It’s about consistency. We’ve designed this system to ensure you can take consistent action, get consistent results, and ultimately scale your business.”

Tune in March for more content from REI Automated, including details of how they’ve seen success and what that looks like for them.